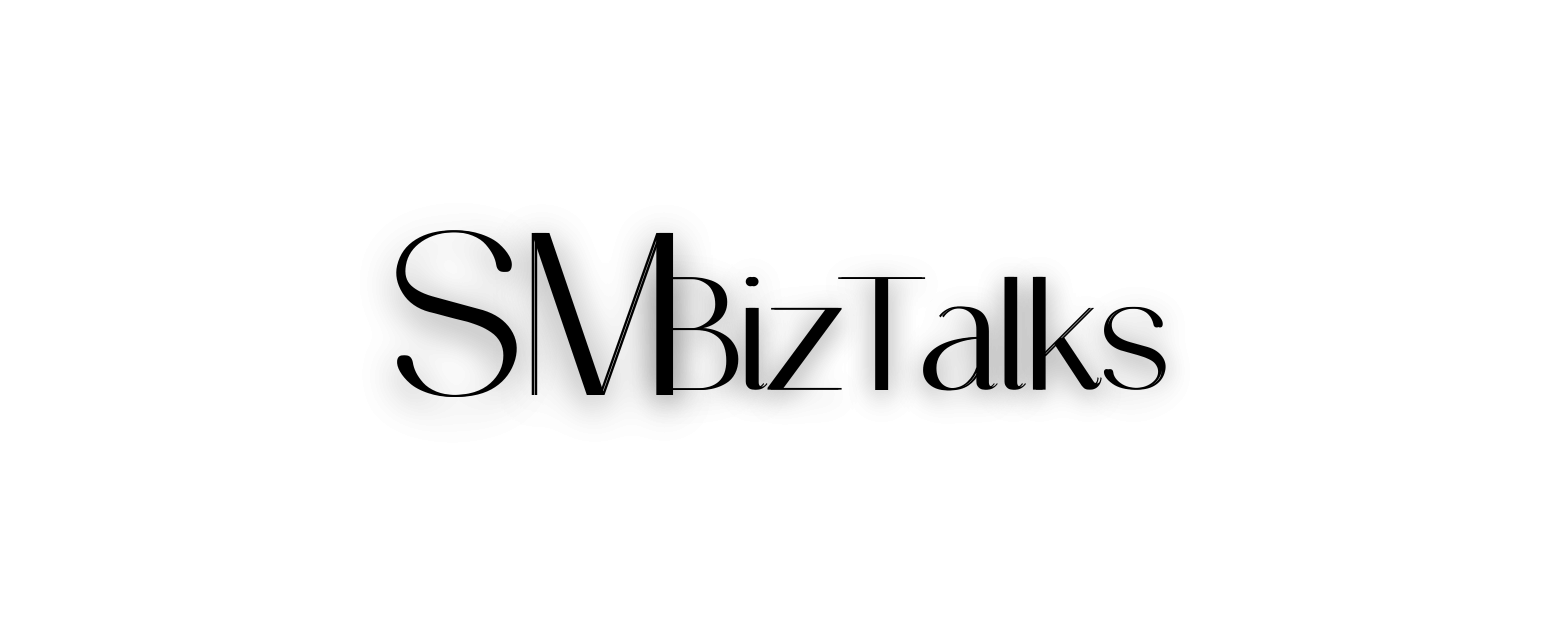

Protecting Your Limited Liability.

There’s still work to be done! Just because you have “LLC” in your business name does not mean you can do anything and be shielded from liability.

LET’S TALK ABOUT IT!

There are FOUR key things you should do to maintain your limited liability!

One

Annual Filings. You must complete your annual filings with your Secretary of State ON TIME. This annual filing requirement is to certify your business is in good standing.

If ever you try to do anything or get anything in your business name, you may be asked for your certificate of good standing. This certificate is only available if you complete your annual filings. Failure to complete this would result in your business being dissolved. If your business is dissolved, then your liability is compromised.

Two

Separation. You started a limited liability company to protect your personal liability. To do this, you must make it clear that your business affairs and your personal affairs are separate.

You should operate anything for your business in your business name. If you are getting a contract drafted for a client or for a service, then it should be in the business name. The business bank account should also be in the business name. Any assets or liabilities incurred under the business, such as a car, should be in the business name.

If ever you are audited and there is no clear separation between you personally and your business, then your limited liability is compromised. This means you can be personally liable for any debt or suits brought against your business. And yes, before you ask… they will DIG to find out how you are truly operating your business.

Three

Operating Agreement. You should always follow what you have outlined in your operating agreement. Every state has laws for businesses. Having an operating agreement acts as the law for your business.

Remember, this is a binding contract that you must follow. Even as a single member LLC, I suggest you get an operating agreement tailored to you and your business.

Four

Funds. Okay so we are at the point where I have to say this. “If you don’t listen to anything I have written, this is KEY!” DO NOT COMMINGLE FUNDS!

Commingling funds means that you are making personal purchases with your business account and business purchases with your personal account. It means that you are not adhering to the second KEY which is separation! You must make it clear, every day and all day that your business and personal accounts are separate.

This may take some getting used to if you are swipe happy. But, if you are intentional about your purpose for starting your business and seeing your business grow, then it will not be a problem.

Remember why you started, then put in the work to get to where you want to be. -SM